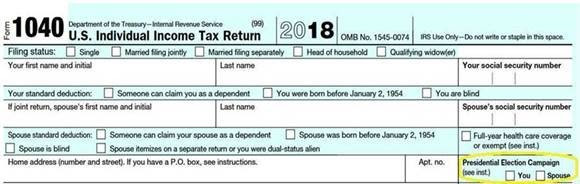

WASHINGTON – Rep. Mark Green (R-TN) introduced a piece of legislation today that would replace the Presidential Election Campaign Fund checkbox on the IRS 1040 with a Border Wall Trust Fund checkbox to allow taxpayers to designate their tax money toward building a southern border wall.

“Taxpayer dollars should never be used to advance political campaigns. But, keeping Americans safe must be our #1 priority,” said Rep. Mark Green. “Americans spoke loud and clear in the 2016 election that we want a wall to secure our southern border. Congress has clearly been unable to get the job done. My bill will give every American the opportunity to directly help President Trump build the wall."

The current IRS 1040 form allows taxpayers to check a box to direct $3 (or $6 for those married filing jointly) of their taxes to the Presidential Election Campaign fund, a rarely utilized account that helps pay for presidential candidates’ attack ads, robocalls, and other campaign expenses. In 2013, only 6% of taxpayers participated in the program.

The Dollars for the Wall Act would eliminate this checkoff box and replace it with a Border Wall Trust Fund checkoff box. This would divert $3 (or $6 for those married filing jointly) of a filer’s existing receipts toward building the wall.