SBA Loans for Tennessee Businesses and Nonprofits

The U.S. Small Business Administration (SBA) is offering designated small businesses and nonprofit organizations low-interest federal disaster loans for working capital to small businesses suffering substantial economic injury as a result of the Coronavirus (COVID-19). As our communities and businesses continue to face the economic impacts of COVID-19, this designation will be a crucial step in providing small businesses the economic capital necessary to overcome the temporary loss of revenue they are experiencing.

- SBA’s Economic Injury Disaster Loans offer up to $2 million in assistance per small business and can provide vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing.

- These loans may be used to pay fixed debts, payroll, accounts payable and other bills that can’t be paid because of the disaster’s impact. The interest rate is 3.75% for small businesses without credit available elsewhere; businesses with credit available elsewhere are not eligible. The interest rate for non-profits is 2.75%.

- SBA offers loans with long-term repayments in order to keep payments affordable, up to a maximum of 30 years. Terms are determined on a case-by-case basis, based upon each borrower’s ability to repay.

To apply, please visit sba.gov/disaster.

- Applicants will need to complete a two-page application, 4506T IRS form to transfer information, and a personal finance statement.

- More information might be requested for more complex businesses or those seeking a higher loan amount.

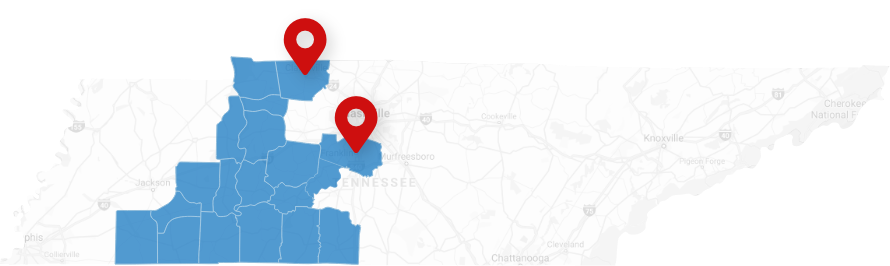

If you have any questions or for additional information, please contact the SBA by phone at 1-800-659-2955 (TTY: 1-800-877-8339) or e-mail at disastercustomerservice@sba.gov. You may also contact the SBA’s Tennessee district offices in Nashville at 615-736-5881 or in Memphis at 901-494-6906. If you have any issues with the SBA, please contact my office at 629-223-6050.

Congressman Green recently shared in a video how the Families First Coronavirus Response Act affects Tennessee businesses. You can check it out here.

For more information and resources on COVID-19, you can find the latest updates here.